Forex Cross Rates

Cross Rates

A foreign exchange market price made in two currencies (not involving the U.S. dollar) that are then both valued against a third currency

Understanding Cross Rate Pairings

Two currencies are being valued against each other, they become a cross-rate pairing. The pairing is then compared to a base currency (e.g., U.S. dollar), creating a cross rate. Some of the more popular cross rates not involving USD include the following:

EUR/JPY = Euro/Japanese Yen FX Cross Rate

EUR/GBP = Euro/UK Pound Sterling FX Cross Rate

CAD/NZD = Canadian Dollar/New Zealand Dollar FX Cross Rate

EUR/SEK = Euro/Swedish Krona FX Cross Rate

How are Cross rates calculated?

A cross rate involves the exchange market price made in two currencies which are then valued to a third currency. During this process, two transactions are being computed.

First being the individual trading their one specific currency (EUR, JPY, GBP, etc.) for that same equivalent value in U.S. dollars. Once U.S. dollars have been received, an exchange occurs again when the U.S. dollars are traded for the second specific currency.

Indirect Quotations

Indirect quotation is a currency quotation that is used to express how much base currency is needed to buy one unit of the quoted currency. It is used also for calculating cross rates.

The bid/offer is an important concept. As mentioned, the USD is the base currency (monetary value of $1), while the non-domestic currency is considered the quoted currency.

This concept varies when it comes to indirect and direct quotations. However, this is because a base currency is still needed for the calculation of two foreign currencies.

We look to calculate EUR/JPY or Euro Yen, which would mean that the base currency in question is the Euro. In this case, the EUR is the base currency, so it must be on the denominator.

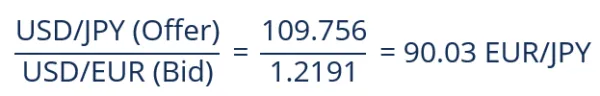

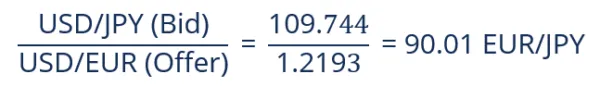

If the client were to sell JPY and buy EUR (offer side), the equation would be as follows:

But if the client were to buy JPY and sell EUR (bid side), the equation would differ slightly:

Direct Quotations

Direct quotation is a currency quotation that is used to express how much of the quoted currency is needed to buy one unit of the base currency.

Similarly to the last example, we will need two foreign exchange pairs and their respective bid/offer valuation in order to conduct calculations.

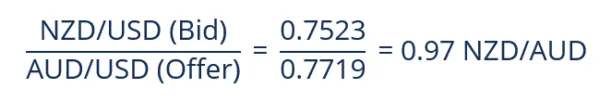

In this case, we will be using NZD/USD (0.7253-0.7256) and AUD/USD (0.7701-0.7719) in order to determine the cross rate of NZD/AUD.

NZD is the base currency, so it must be in the numerator.

If the client were to buy AUD and sell NZD (bid side), the calculation would be as follows:

But if the client were to sell AUD and buy NZD (offer side), the calculation would change to:

The bank’s perspective of the NZD/AUD cross rate would be 0.94-0.97.